It’s all in the tails: investors need a fresh approach to managing tail risk

Normal events are reported in newspapers. Extraordinary events end up in history books. 95% of what happens in life occurs within two standard deviations of the norm.

However, the interesting stuff happens outside of these two standard deviations. This is where fortunes are made and lost. And this tail risk territory is where investors should be looking now. Those investors who have given serious consideration to their portfolio’s fragility and the probabilistic tails, and who look outside of the norm, will be better off.

US Monetary Policy – a financial form of iatrogenics

Since the late 1970s, US Monetary Policy has been one of bubble to bubble creation and management. In this context, the Federal Reserve, the ‘Fed’, has acted as both arsonist and fireman. The big financial crises of the last 40 years were caused by excess credit inflating asset bubbles, which then burst. New interest rate lows were set, leading to spontaneous combustion of the next asset class of choice and so on.

Every interest rate low was followed by a lower low. The savings and loans crisis of the 1980s, the dot com bubble of the late 1990s, the subprime mortgage industry collapse of 2008 and finally 2020, the COVID-19 crisis. Now the rates are at 0% and on a path to possibly becoming negative.

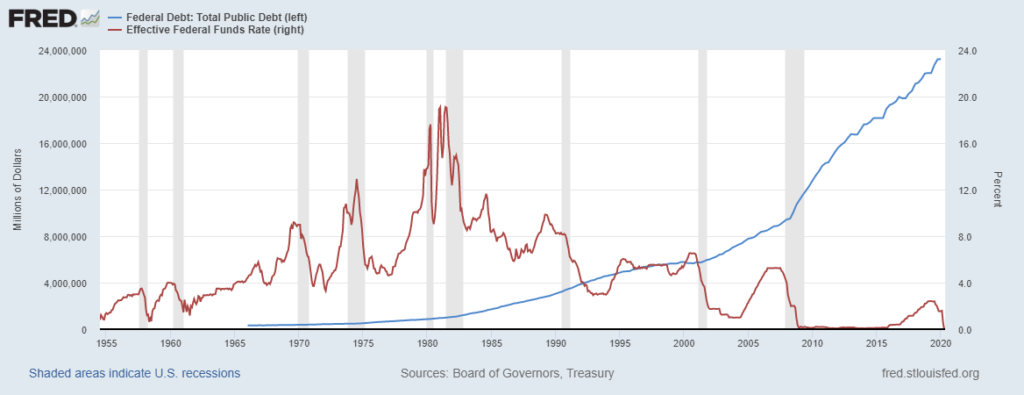

With real interest rates having been at or below zero since 2009 and several rounds of quantitative easing (QE), the US federal debt more than doubled. The monetary policy in Europe not being dissimilar resulted in the global financial system being highly vulnerable to an exogenous shock like the pandemic.

Accessed via FRED

The Fed has engaged in the economic equivalent of iatrogenics – harm given to you by someone supposed to help you. Much like the potential side-effects of medical drugs, the solutions to solve the first-order consequences of a situation create worse second and subsequent order consequences.

Trillions of dollars have been injected into the economy. On March 26, 2020, for the first time in history, US bank capital reserve requirement ratios were reduced to zero per cent. The Fed has pulled out all the stops. Commercial banks can now issue unlimited credit.

“On March 26, 2020, for the first time in history, US bank capital reserve requirement ratios were reduced to zero per cent.”

In November 2019, Fed Chairman Jerome Powell called US debt “unsustainable”. That was four months before the pandemic took hold. What are the consequences of adulterated interest rates, manipulated asset prices and a doubling in the public debt over the last 10 years? All topped by the most recent sumo portion of debt at the all you can borrow buffet.

Investors and markets will collide with the real world, eventually

The first week of June ended with the S&P 500 Index down only 1.4% and the NASDAQ-100 index up 11.8% for the year.

With a US unemployment rate of nearly 15%, it appears investor strategy remains oblivious to Main Street’s economic mayhem.

Many overleveraged companies that should have gone bankrupt in years leading to and during early 2020 have been bailed out. As a result, the system did not clean itself from its excesses. Investors are still holding zombie companies that will create a drag on the performance of their portfolios.

Western economies are starting to feel the effects of low interest rates, lower birth rates and an aging population. When you look at the performance of the Nikkei since its highs 30 years ago, and consider the economic and demographic drivers, investors may wish to reconsider the opportunities of index investing.

Indeed, starting about 20 years ago and accentuated by the low growth and low interest rate environment of the last decade, institutional investors have flocked to index investing, in part to reduce management fees.

The prevalent mentality is consensus, groupthink. Acting with the crowd ensures an acceptable mediocrity; acting independently runs the risk of unacceptable underperformance. The pressure to retain clients exerts a stifling influence on asset managers.

Since clients frequently replace the worst-performing managers, and money managers live in fear of this, most try to avoid standing apart from the crowd. Those with only average results are considerably less likely to lose accounts than are the worst performers. The result is that most money managers consider mediocre performance acceptable.

What was your tail risk strategy?

The recent government directed shutdown was a watershed event and reminds us that big changes can happen very quickly. Investors and policymakers should have been addressing the tails that were getting fatter with increased leverage in the system. Pandemic risk was discussed by governments and the private sector but was not adequately planned for.

Some market participants and policymakers are thinking about how to better run our financial system. Rethinking economic models is essential. The discipline of economics must open itself to new insights and to innovation in the way we think about and manage risk. Economics and investing must also focus on what appear to be long forgotten principles: discipline and common sense.

Investors should also consider tail risks and manage the variance. For example, what will the consequences of the recent global central banks’ actions be when added to the QE of the last decade? How will all the other risks we face affect portfolios? We must consider pandemics and economic shut down, cyber risks, supply chains, transportation, regulatory risks, war and terrorism, among others.

How long can the Fed intervene in, or manipulate, the credit markets, which in reality also means the equity and currency markets? Under what circumstances does the Fed lose control?

How do you put capital at risk for more security?

How do you put capital at risk when the outlook is more uncertain than at any time in history? Investing is about positioning your capital to profit from future developments, yet we do not know what the future holds. What are the tail risks of your investment?

Recent events have shown us that anything is possible. We must invest in good quality, low risk or de-risked companies, in other words, value. Yet, nobody knows the future and we must all make decisions today, based on the past, about a future we cannot predict.

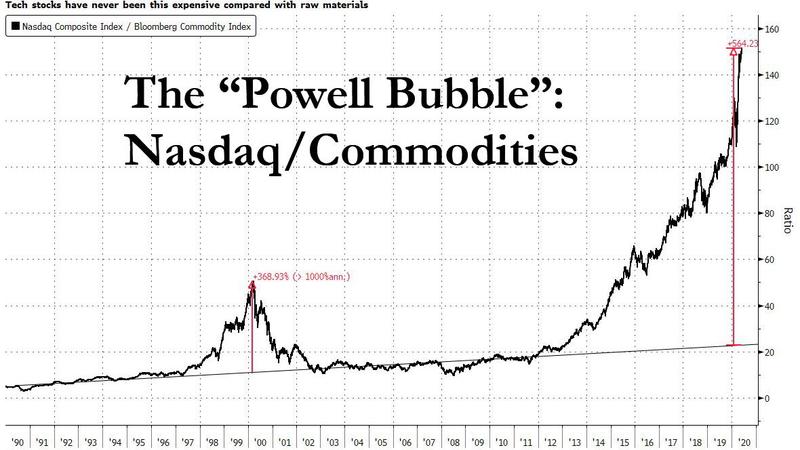

In terms of relative value, commodities appear to be grossly undervalued. The Nasdaq is trading at around a 150x multiple of the Bloomberg Commodity Index, surpassing the highs of around 50x seen during the Dot Com bubble. Relative to the high-flying Nasdaq Composite Index, commodities have never been so cheap.

Accessed via ZeroHedge

Investors must plan for the unexpected and make their portfolios convex. An investment is convex if the payoff is unbalanced for equally opposite outcomes. If there is the potential to earn a profit of two on a bet, versus a maximum loss of one, the bet is positively convex.

Ultimate convexity is a one-way bet. In public-markets, one way to attain convexity is to buy a high-quality company cheaply in a panic-selling event when good quality is sold at a low price regardless of its high intrinsic value. The economic crisis induced by the shutdown will generate many such opportunities. Managers who apply the approaches of the Graham and Dodd school, including Warren Buffet of Berkshire Hathaway, will buy companies with convex investment profiles.

When there is a variation of returns, the red dot moves linearly up and down, whereas the blue dot, representing a convex portfolio, has less to fall and a greater upside.

Accessed via Hussman Funds

Investors require powerful tools when financing risk and innovation

At any time, when putting capital at risk in new technologies, the risks are statistically unquantifiable because there is no available data. Similarly, in COVID-19 times, there is no statistical data to analyze macroeconomics and the effects of large scale monetary policy on portfolios. There are the known, unknowns and the unknown unknowns. This is where probabilistic analysis comes into play.

Thinking about, defining and quantifying risks in a probabilistic manner, alongside other strategies to address and mitigate tail risk, can produce an investment with a convex return profile.

For decades, Fortune 100 and other companies in many industries have successfully used probabilistic analysis to manage project risk. Although rarely used in asset management, probabilistic analysis leaves the decision maker in a better position to avoid, manage or accept risks. Using these powerful tools can help you get the best perspective when assessing risks, managing variance and creating convex portfolios. These tools all help give you an edge when investing in growth stage industrial technology companies, aerospace, energy and other industries.

Your successful investment strategy does lie in the tails

Just throwing money at an opportunity is neither efficient nor rewarding. Negating the tails is essential. Furthermore, opportunities in illiquid investments are negotiated on a case-by-case basis. This generally offers greater flexibility over the terms because of the number of risks and other moving parts in a deal. Because investors value liquidity, private companies should sell at a discount when compared to public companies.

Finally, because of the numerous perceived risks of growth stage companies, the valuations are generally more attractive than those of the liquid mature companies. If you can mitigate tail risks, you increase the return profile of the opportunity.

Fortunes are made and lost in the tails. Identifying them and mitigating the risks that can cause ruin with active and well-defined strategies, designed to create convexity in your portfolio, will make the difference between a successful investment strategy and a mediocre one.

Christian is the Director of Capital Development at Finance Technology Leverage (FTL). By financing exciting and challenging projects, FTL unlocks new advances in energy, industrial technology and the life sciences. Contact us for more information.

U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEBTN, June 15, 2020.

Board of Governors of the Federal Reserve System (US), Effective Federal Funds Rate [FEDFUNDS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS, June 15, 2020.